puerto rico tax incentives 2020

Act 172 of 2020 Act 172-2020 amends the. Any other tourism sector if the Secretary of the DDEC determines that the operation is necessary and convenient for the development of tourism in Puerto Rico.

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

4 or 8 fixed income tax rate.

. More importantly the requirements for each program have been adjusted. In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. This resulted in some adjustments to the qualification requirements among other changes.

Tourism Tax credits of either 30 or 40 of the Tourism Eligible Investment which generally includes the amount of cash contributed to the exempt business in exchange for its ownership interest and loans. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here. These include a fixed corporate income tax rate one.

An economic development tool based on fiscal responsibility transparency and ease of doing business. As of 2020 Puerto Rico actually consolidated all of these tax acts into one Act 60 of the Incentives Code. Changes to Act 2022 New Incentives Code of Puerto Rico for Jan 1 2020.

2 or 12 withholding tax on royalty payments. To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide greater transparency Act 60-2019 was signed which establishes the new Puerto Rico Incentive Code. Act 22 Tax Incentives 0 tax exemption on capital gains and interest.

The tax incentive offer is mainly a four 4 income tax rate for new banking and financial businesses established in Puerto Rico under qualifying circumstances. Act 27 Tax Incentives Big. These have mainly come in the form of tax incentives Act 20 and Act 22 but there are a number of other minor incentive acts in place.

Act 20 Tax Incentives 4 corporate tax rate plus big exemptions. Under this new law known as the Incentives Code Acts 20 and 22 have been consolidated into Act 60 and were subsequently renamed. Residential housing acquisition incentives.

New Business Created by Young Entrepreneurs. First in order to qualify for Act 22 you need to make an annual donation to official charities in Puerto Rico and in 2020 the donation amount increased from 5000 to 10000. Ten 10 years Part I Detail of Net Operating Losses for Regular Tax Purposes 00 00 00 00 00 00 00 00 00 00 00 00 00 1 2 3 4 5 6 7 8 9 10.

The legislation allows Puerto Rico to offer qualifying businesses that export services from the island nation the opportunity to cut their corporate tax rate to a mere 4. 2020 Year-end amendments to the Puerto Rico Incentives Code I. We have reviewed the language of the new law and are pleased to share the major changes to the Act 20 and 22 program below.

Puerto Rico Incentives Code Act. As of January 1 2020 Act 20 and 22 have been replaced by Act 60 which brings with it some changes to the requirements. Act 169-2020 integrates real estate tax incentives established in Act.

Major changes were made to Act 20 and Act 22 on July 11 2017 the most popular of Puerto Ricos tax incentives. Export of Goods and Services Tax Incentives. Please note that the new Incentives Code made Act 22 more expensive in 2020.

On 1 July 2019 the Governor of Puerto Rico signed into law Act 60 also known as the Puerto Rico Tax Incentives Code Incentives Code which consolidated dozens of tax decrees incentives subsidies and tax benefits in a single statute. Puerto Rico tax and incentives guide 2020 5 Although economic growth has decreased during the last years Puerto Rico offers tax incentives packages which can prove attractive to companies from the United States and other countries. Business that begins its main commercial operation after signing a Special Agreement for the Creation of.

Below is an updated review of Puerto Ricos tax incentives for 2017. In order to promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide. Now known as Chapter 3 of the Incentives Code Puerto Ricos Act 20 was originally known as the Export Services Act.

As of 2020 Puerto Rico actually consolidated all of these tax acts into one Act 60 of the Incentives Code.

The Puerto Rico Tax Haven Will Act 20 Work For You

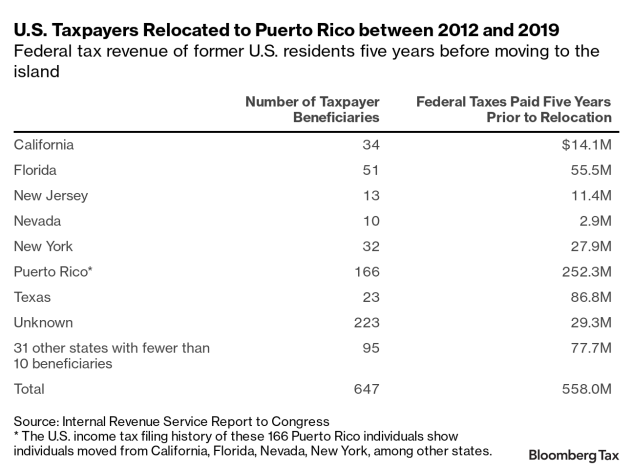

Sm Best Places Pr Report Puerto Rico Person Federal Income Tax

2020 New Jersey Solar Incentives Tax Credits Rebates Energysage Solar Companies Solar Vivint Solar

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

California Solar Tax Incentives 2020 California Solar Programs Ampsun Energy Inc What Is The Solar Tax Credit For 2020 Ca Solar Program Free Solar Solar

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

How To Become A Bona Fide Resident Of Puerto Rico Prelocate

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

The Next 10 Years Will Be About Market Networks Networking Marketing 10 Years

Irs Seizes Foothold On Puerto Rico Tax Haven Audits

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico Tax And Incentives Guide Grant Thornton

Instalacion De Equipos Solares En Puerto Rico Venta E Instalacion De Placas Y Equipos Solares En Puerto Rico Eq Puerto Rico Equipo Instituciones Financieras

10 Best Cars For Dog Lovers Autotrader Kia Subaru Outback For Sale Best Wagons

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors